ScoreNavigator's Mortgage Action Plan is designed to align Credit Reporting Agencies, loan officers workflows, and consumer action plans—so mortgage readiness becomes measurable and manageable.

Join the growing network of CRAs and mortgage professionals using ScoreNavigator

You don't necessarily have to work hard all the time. Instead, work smart. By being financially and credit savvy, you can:

The sky's the limit! It all starts with you and it starts now!

$400

677

We'll help you identify the accounts that are hurting you, and then guide you on how to get those points back!

While having good intentions or big dreams is great, it isn't enough. To fully realize your vision for your life, you should map out a plan to make that happen. This includes setting credit goals that support your values and priorities.

Your financial goals need to be meaningful, relevant and aligned with your values. To stay on track with your financial targets, you'll also want to create both short-term and long-term goals. Short-term financial goals are easier to achieve. They can help you reach your long-term goals.

ScoreNavigator has everything you need to make sense of and take control of your financial standing. From credit score report services and Point Deduction Technology® to personalized financial calculators and professional advice, we have it all. Enroll today to get all the benefits!

Learn the language of credit with our comprehensive glossary covering terms from A to Z, including debt, credit limits, interest rates, and more.

Expert guidance on navigating life events, maximizing your credit score, preparing for major purchases, and mastering credit basics to reach your goals.

Learn how to establish and grow your credit through tradelines, alternative credit options, and strategic account management.

Learn how to protect yourself from identity theft and fraud, and what to do if your personal information is compromised.

Take control of your finances by tracking income and expenses, and see where you can make changes to reach your goals.

Never miss a payment with our visual calendar that tracks your bills, due dates, and helps you plan your cash flow.

Set meaningful credit and financial goals, track your progress, and create a personalized roadmap to achieve the score you need.

Get answers to commonly asked questions about credit, financial planning, education resources, and how to make the most of ScoreNavigator.

Financial calculators, credit laws, consumer rights, behavioral finance insights, and so much more to explore inside.

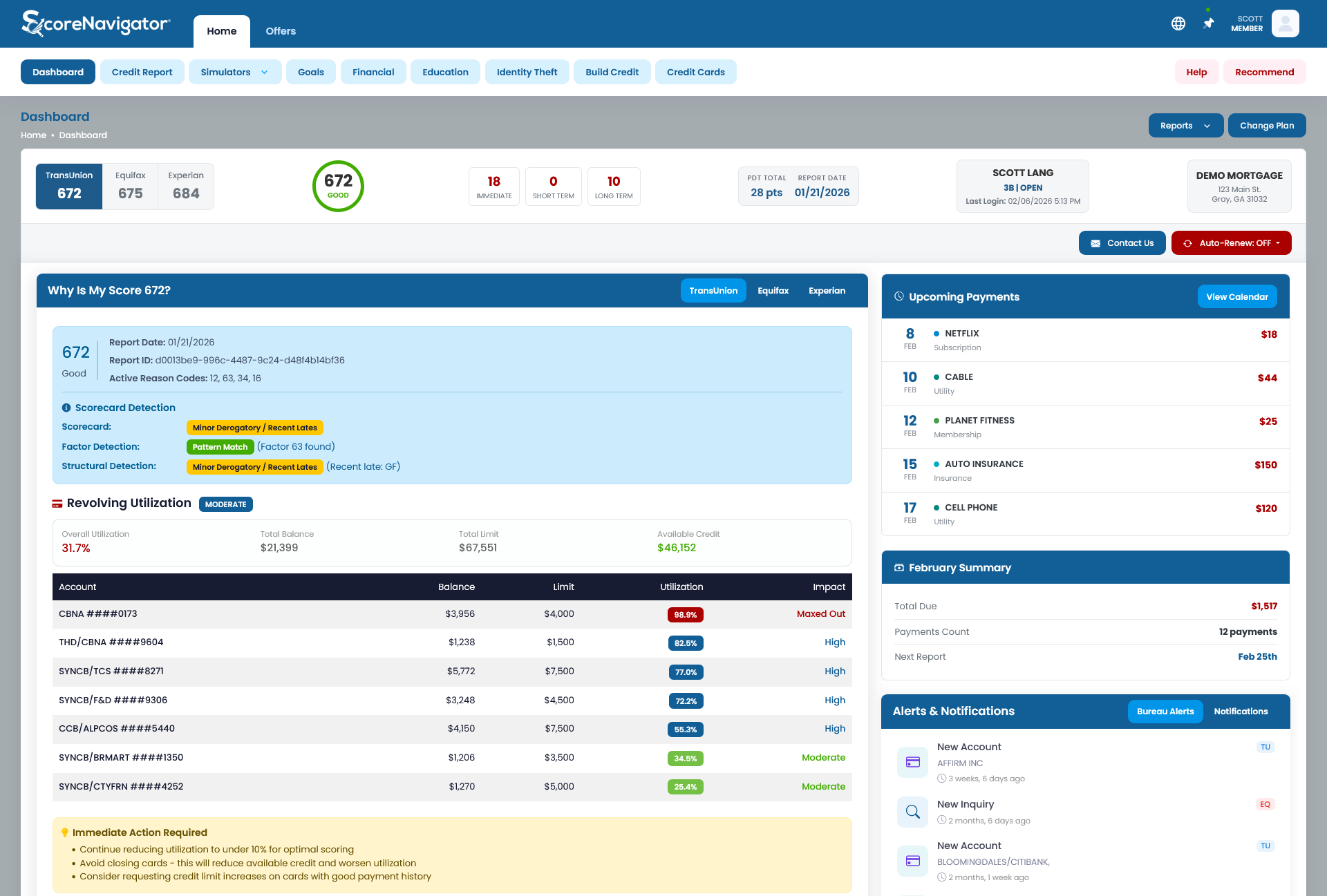

Finally understand what's really driving your score. Our Point Deduction Technology® reveals how many points each account is costing you, so you know exactly where to focus.

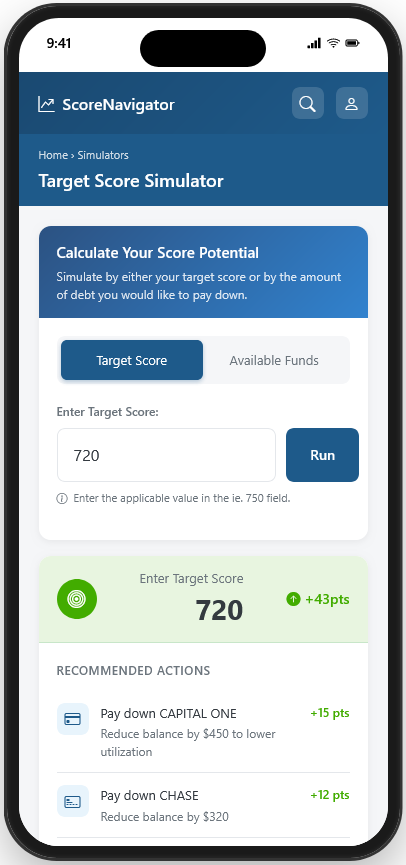

Then our powerful simulators let you explore different scenarios and create a personalized action plan with specific steps and dollar amounts. It's credit education that actually makes sense.

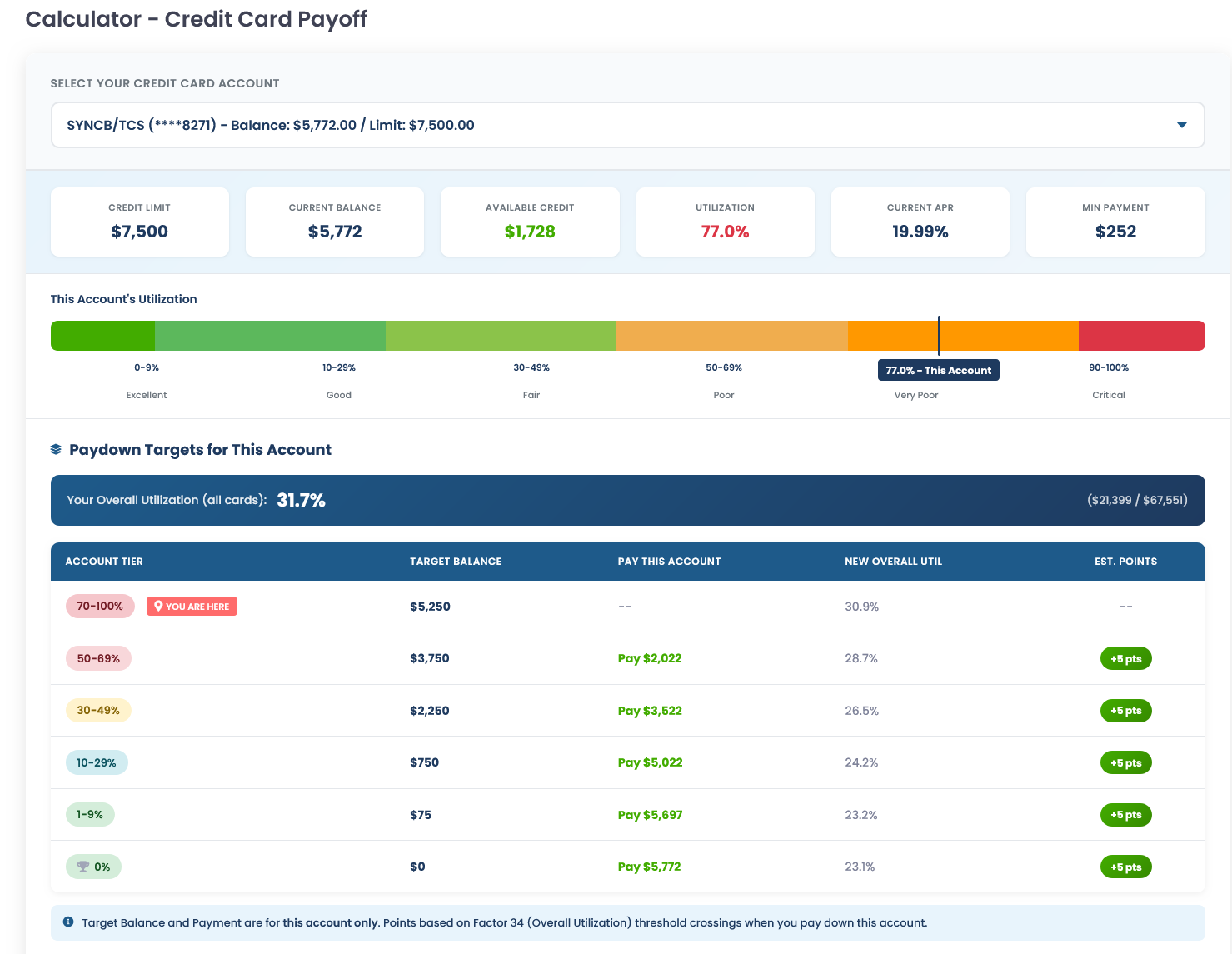

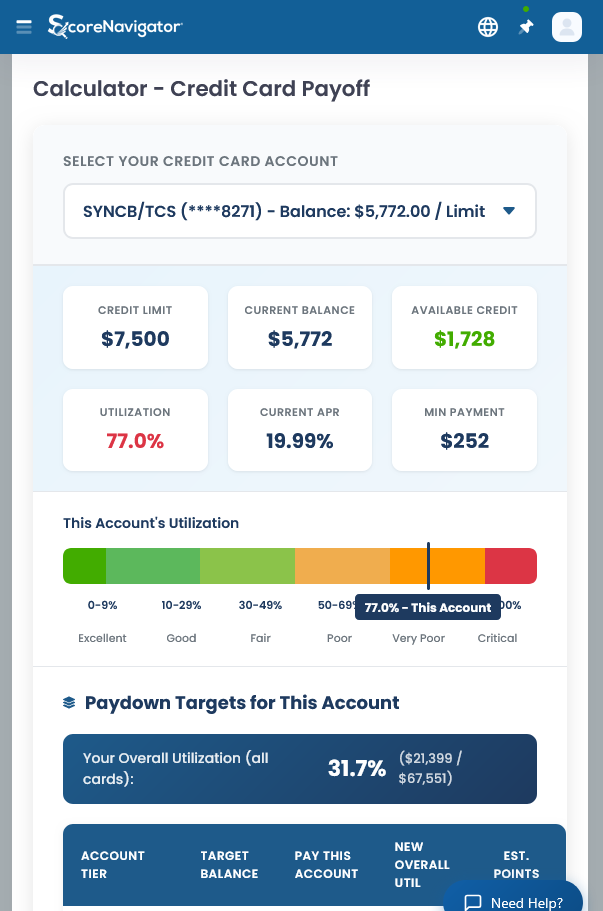

ScoreNavigator includes powerful calculators to help you plan debt payoff, analyze mortgages, and make smarter financial decisions.

See what it takes to pay off your balance and what changes will help you reach your goals.

Find the best distribution of your debt and which balance transfers save you the most.

Accelerate your debt payoff and save thousands by applying payment savings strategically.

Discover how expensive your debt really is and how long it will take to pay it all off.

Determine your monthly payment and generate an amortization schedule with prepayment options.

Apply bi-weekly payment savings to your current mortgage and see how much you can save.

See how much interest you can save by increasing your auto loan payment.

Consolidate student loans and use payment savings to accelerate payoff of higher-interest debt.

Analyze your budget as a full-time student with expenses and income for the school year.

We've helped countless individuals reclaim their financial independence by demystifying credit scores, showing them what impacts their score, and developing actionable strategies for improvement. Look at what they have to say about working with ScoreNavigator.

Since 2009, Homes for Heroes, Inc., has helped over 63,000 heroes save over $122 million on their real estate transactions, sold over $17 billion in real estate to heroes, actively partnered with more than 4,300 like-minded real estate and mortgage professionals who’ve joined in the mission, and donated over $1.4 million to heroes in need through the Homes for Heroes Foundation.

This achievement indicates that our handling and processing of customers' data meets key security standards. The protection of customer data is the highest priority for our team and we're committed to building a robust security & compliance program. We're thrilled to celebrate this milestone as another way of building trust with our customers.

We partnered with Vanta & Advantage Partners to seamlessly guide us through the compliance process.

"Faith, Family and Finance" is an inspiring and practical guide to achieving financial stability and success through the lens of faith and family values.

With forty years of experience in financial planning and counseling, This book offers its readers practical advice on budgeting, saving, investing, and managing debt, while also exploring the deeper spiritual and emotional aspects of money and its role in our lives. Through personal anecdotes and insightful reflections, this book shows how aligning our financial goals with our faith and family values can bring greater meaning and purpose to our lives, as well as greater financial security.

Whether you are struggling to make ends meet or simply looking for ways to enhance your financial well-being, "Faith, Family and Finance" offers a wealth of practical tools, tips, and strategies to help you achieve your financial goals while remaining true to your values and priorities. With its clear, engaging style and heartfelt message, this book is sure to become a treasured resource for anyone seeking financial freedom and a deeper connection to their faith and family.

New This Year - 15 winners!

In an era where financial independence and literacy are pivotal, many young individuals find themselves navigating through a maze of financial decisions without a compass. Recognizing this critical gap, The Scorenavigator Financial Literacy Scholarship Fund proudly announces its 4th Annual Scholarship initiative, dedicated to empowering the next generation with the financial acumen necessary for a prosperous future.

This year, we continue our commitment to support high school juniors and seniors from low-income backgrounds who demonstrate academic excellence with a GPA of 3.0 or higher. Our scholarship aims not just to alleviate the burden of educational expenses but to invest in the financial education of our youth, ensuring they are equipped with the knowledge to make informed financial decisions.